Responsible Private Equity

Research insights and tools to maximize private equity's potential to drive better financial returns through sustainability

Private markets have a unique opportunity to create value for investors, portfolio companies and society by embedding sustainability strategies that can improve financial performance.

Private equity has a long record of bringing strategic insights and operational excellence to portfolio companies. In today’s world of material environmental and social challenges, these skills can be applied to sustainability practices that will drive operational efficiencies, innovation and growth, risk mitigation, employee engagement and productivity, supplier resiliency, and more.

CSB's research is anchored in understanding the value drivers underlying sustainability practices across industries, and we have turned that lens to private equity. First, we reviewed the academic literature about private equity’s performance in a series of impact categories and summarized our findings through the Responsible Investing Framework that defines best practice for both PE firm leadership and portfolio companies. Then, extensive interviews with GPs and LPs further informed the creation of new tools that help investors and portfolio companies identify material sustainability-related risk and opportunities, and develop strategies to create new enterprise value.

Tools for GPs and LPs to Unlock Financial Value Through Sustainability Strategies

Based on feedback and piloting with General Partners (GPs) and Limited Partners (LPs), NYU Stern CSB has developed tools to help embed sustainability strategies that drive better financial performance with PE investment processes. These tools aim to improve several gaps identified in our research, including:

- Lack of sustainability value creation expertise amongst GPs, LPs, and portfolio companies

- Primary focus is on risk, compliance and reporting, rather than value creation

- A lack of metrics and systems to assess and capture the financial benefits of sustainability strategies despite a growing desire across the ecosystem to build and track the “sustainability value creation stories” of portfolio companies

- Lack of clarity around what type of sustainability and Return on Sustainability Investment (ROSI) KPIs should be tracked, and how these can be tied to the underlying financial case of specific sustainability strategies

Tools For General Partners

Sustainability Strategy Prioritization and Financial Value Driver Tool for Portfolio Companies

This updated, two-part assessment and strategy tool assists GPs and Investors in analyzing both target and acquired portfolio companies’ current performance on sustainability-related material issues and provides guidance on which sustainability strategies and practices can drive financial value for the target company.

The tool is intended to be used first during the due diligence phase to gain a high-level assessment of where the company stands regarding its sustainability-related material issues. In Stage 1, after selecting the Industry, the model automatically populates the relevant material issues (aligned with SASB industry standards) as well as NYU CSB-defined strategies, practices, and value drivers. The tool then guides the assessment of the target company across several criteria for each material issue, using easy drop-down menu choices. This assessment establishes a pulse check on the target company’s performance, identifying red flags and upside opportunities. Results are captured in a heat map (Figure 1).

Figure 1: Due Diligence Heat Map

In Stage 2 (generally during the early holding period of the acquired company), the tool scores or ranks sustainability-related risks and opportunities that can drive improved financial performance, prioritizing material issues-- which then informs strategy and KPI development. Based on issue prioritization, the tool provides example practice(s), KPIs, and monetization methods based on NYU CSB’s ROSI methodology that can be used to quantify and track sustainability initiatives.

Conducting this type of analysis at the beginning of the investment allows the GP to identify and prioritize key material issues early on and craft strategies and KPIs to address the areas which add value to the portfolio company. Tracking sustainability and financial KPIs over time allows the GP to create a record of sustainability improvement (while mitigating key risks) over the lifetime of the holding. At exit, the GP can more easily articulate the sustainable growth story and greater resilience within the portfolio company.

Output from Stage 2 includes an issue prioritization (materiality) matrix (Figure 2) and database of value drivers, example practices, KPIs, and monetization methods for each material issue that the user has decided to prioritize (Figure 3).

Figure 2: Scatterplot highlighting sustainability strategy priorities

Figure 3: Database of sustainability and related value creation (ROSI) KPIs

After identifying ROSI KPIs in this tool, we encourage users to refer to the ROSI website to get additional monetization tools and ideas to take your analysis to the next level of detail regarding value creation through sustainability initiatives.

We welcome your feedback. Please reach out for any questions, comments, or guidance: sustainablebusiness@stern.nyu.edu

Following are the links to the open-source, Excel-based GP tools. We suggest you review the deck for a quick introduction. You may wish to review the tool with the Kraft Heinz example input to see how it works in action.

- GP Value Driver Tool: a blank template of the two-stage, Excel-based tool

- Introductory Slide Deck: introducing the GP Value Driver Tool

- GP Value Driver Tool Example: filled out for Kraft Heinz to illustrate how the tool works with inputs provided

- Extensive Database for Sustainability and ROSI KPIs: for additional resources

After identifying ROSI KPIs in this tool, explore the ROSI page on NYU Stern CSB's website for additional monetization tools & ideas. Access the site here.

GP Sustainability Value Driver Tool Case Studies

Several private equity firms piloted the GP Sustainability Value Driver Tool and reported key insights from the process of

1) assessing the value creation implications of material sustainability issues;

2) defining the future upside/downside opportunities of investing in sustainability initiatives; and

3) defining sustainability and ROSI KPIs to establish value creation at exit.

BSR and Arthur D Little provided pro bono support to help the companies pilot the tool.

Click below to learn more about each case study’s process and findings.

Case Study: Kohlberg & Co, with pro bono support from BSR, used the value creation tool to help link diligence findings with post-acquisition strategy development for a portfolio company in the healthcare sector.

Diligence Assessment

Kohlberg’s diligence assessment identified performance on key material issues for the company: labor practices; business ethics; product quality & safety; employee health & safety; physical impacts of climate change; and GHG emissions, as well as the value creation/destruction possibilities

Issue Prioritization and Strategy Development

Based on the upside/downside and level of effort required to tackle the different issues, using the tool, the team prioritized mitigating climate-related downside risks impacts and capitalizing on climate-related upside opportunities.

The ROSI methodology and Kohlberg Process informed the development of the business case for formalizing ESG and climate programs. Planned implementation includes:

- annual assessment of Scopes 1, 2 and 3 emissions

- developing a decarbonization roadmap with a focus on the highest ROI initiatives

- achieving accreditation for ESG and climate-improvements

- leveraging ESG/climate program as a competitive advantage

Key Value Creation Insight: The company stands to create financial value by avoidance of regulatory non-compliance penalties, targeting customers with climate and ESG goals, and tracking savings from energy efficiencies through decarbonization.

Case Study: NB Renaissance, with pro bono support from BSR, used the value creation tool to evaluate opportunities for a recent acquisition of an Italian apparel, accessories, and footwear company.

Diligence Assessment

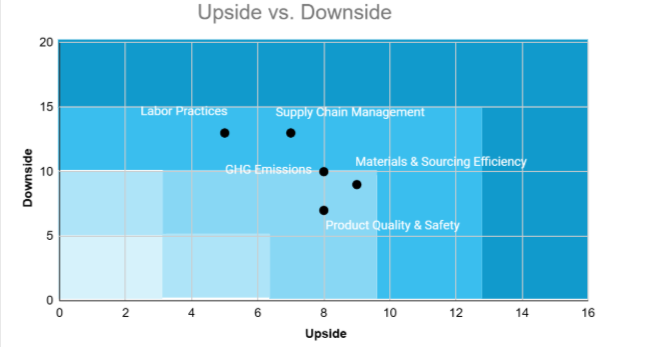

The diligence assessment identified labor practices; supply chain management; materials sourcing & efficiency; product quality & safety; and GhG emissions as material topics for exploration. Each issue was then scored by their current state and estimated downside and upside.

Issue Prioritization and Strategy Development

Mapping these issues, the tool identified labor practices as an area with significant opportunity for improvement, as well as high downside risk.

The firm used the ROSI methodology to monetize proposed benefits that make up a multi-year governance, training, and communications plan to address the social welfare and health and safety of employees. Implementation plans includes:

- implementing competitive salary and benefits, including health insurance support

- engaging the workforce in sustainability practices

- improving workplace health and safety culture

- promoting employee welfare and ethical behavior

- creating clear and equitable career development and promotion pathways

- target Ecovardis Silver rating in 2026

Key Value Creation Insight: The company can realize direct ROSI benefits from operational efficiency, including reducing absenteeism rate by 15% and avoiding the cost of extraordinary hours by ensuring 100% machine productivity. Further indirect monetization benefits include financing accessibility, saving €300k per year by securing ESG-linked financing, and customer retention, driving lower risk to ~€85 million of business associated with sustainability-minded customers (30% of total business).

Case Study: The Builders Fund, with pro bono support from Arthur D. Little, used the GP value creation tool to develop an actionable investment roadmap for their portfolio company, a leading provider of leased solar and energy.

Diligence Assessment

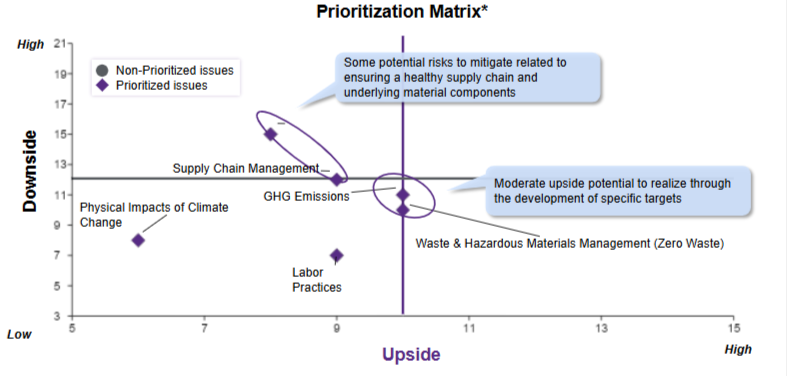

The tool helped narrow 17 relevant issues down to 6 key material issues including labor practices; waste reduction; GHG emissions; supply chain management; physical impacts of climate change; and reducing harmful chemicals and materials. Status scores were applied based on how well current practices manage for each material issue.

Issue Prioritization and Strategy Development

Top material issues of zero waste targets and supply chain management were prioritized due to high downside risk and moderate potential upside.

Builders created specific practices, KPIs, and value creation potential for related practices. Proposed implementation plans include:

- develop zero waste principles and end of life management practices

- establish baseline of Scopes 1-3 and set targets for reduction

- implement incentives for suppliers to engage in sustainable sourcing

- introduce training program for relevant employees on waste reduction

Key Value Creation Insight: By implementing a recycling program for used solar panels, the company could reduce significant waste, create a new line of business at a lower price point opening the market to new customers, and realize >$6.6M value creation opportunity in total

Case Study: A middle-market private equity firm, with pro bono support from BSR, used the value creation tool on a recent investment in the technology communications sector.

Diligence Assessment

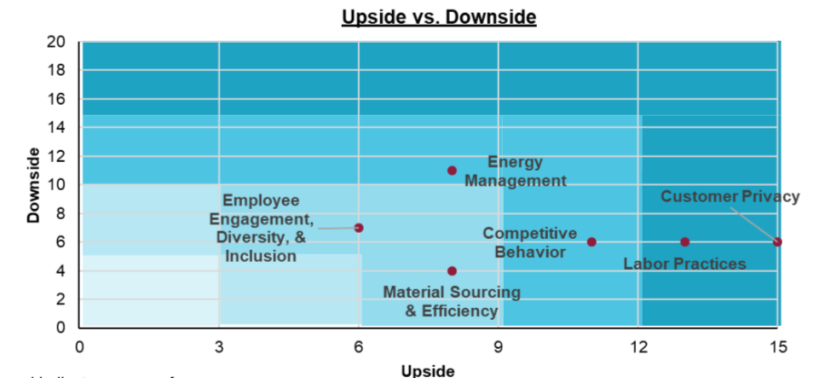

The diligence assessment identified energy management, custom privacy, employee engagement, material sourcing & efficiency, labor practices, and competitive behavior as material topics to the company. Each issue was then scored by their current state and estimated downside and upside.

Issue Prioritization and Strategy Development

The firm identified labor practices as an area with significant upside potential, and relatedly, employee engagement as having opportunity for improvement.

The PE firm used the ROSI methodology to assess potential benefits and strategies to track and monetize programs aimed at improving employee health and safety, worker wellbeing, diversity, and equity.

Key Value Creation Insight: The company documented a 38% reduction in total recorded incident rates, significantly below industry average, achieved 95% completion rate of DEI training, and reached 50% enrollment on the internal employee engagement platform within two weeks of launch.

Survey Tool for LPs: Assessing GP Sustainability-Linked Value Creation Approach

In a Bain report, 50% of LPs surveyed cited better investment performance as a key reason to incorporate ESG. However, according to interviews conducted by NYU Stern CSB, Limited Partners typically do not have much hands-on involvement in their investments and tracking the GP commitment to sustainability-linked value creation and preservation can be difficult.

Yet there is strong agreement on the need for guidance that links sustainability to value creation, not just compliance. To address this, CSB worked with a group of LPs over 18 months to develop and pilot questions for GPs focused on how sustainability strategies create and preserve value.

This emphasis on connecting sustainability to financial performance also resonates with GPs, who must navigate divergent expectations: many LPs continue to be sustainability-forward, while some are skeptical of ESG. Our tools help LPs bring clarity and consistency to these conversations:

- Sustainability-Linked Value Creation Guide for Private Equity Limited Partners – a comprehensive overview of sustainability-linked value creation, including five guiding questions and illustrative examples.

- Stand-alone Value Creation Questions – The five value creation questions, formatted for quick integration into due diligence or monitoring.

- Sustainability-Linked Value Creation Examples – case studies highlighting how sustainability-linked initiatives can translate into measurable financial outcomes.

If you are interested in piloting the tool and sharing your findings, please reach out to Tensie Whelan at twhelan@stern.nyu.edu.

An Asynchronous Course for Portfolio Companies and General Partners on How to Embed Sustainability in Corporate Strategy and Unlock Financial Value

Embedding Sustainability for Improved Portfolio Company Performance

Based on our interviews and work with private equity, we find that most portfolio firms do not have sustainability expertise on staff, which limits their ability to design and execute on sustainability strategies that will unlock better financial performance. We built this free, open source asynchronous course for portfolio companies (and PE firm employees) based on our expertise in teaching practitioners. It can be executed on your own timeframe (should take a few hours to be complete and can be done in stages) and covers everything from developing ESG materiality and sustainability strategies to defining and tracking sustainability related financial returns to governance and culture topics. It includes brief quizzes to check your understanding of the concepts. Register for the class here.

Sustainability Value Creation Framework

Sustainability can drive financial returns, build resilience, and position for success. Additionally, investors anticipate sustainability will deliver an even greater positive impact on financial results in future. Integrating relevant drivers and initiatives into portfolio company business strategy is key. To do this, investors and portfolio companies must be able to link value creation through sustainability to financial outcomes and secure stakeholder buy-in.

CSB joined UNPRI and Bain & Company as the academic partner in publishing The Sustainability Value Creation (SVC) framework, a holistic approach for driving financial value through sustainability. This guide and provides an extensive overview to support value creation through sustainability in private markets.

NYU Stern would like to thank Arthur D. Little for providing a pro bono secondment to support the development of the GP tool, Investindustrial for contributing grant funds and expertise, ClimateWorks for providing a grant for the development of these tools and the U.S. Endowment for Forestry and Communities for helping to fund the first phase of research.

A Responsible Investing Framework, Insights, and Cases Toward a Positive Pathway

An analysis of the Responsible Investing Framework’s key findings and real-world applications. The whitepaper walks through each category with examples of problematic and positive PE practice, providing insights into pathways that provide positive results for shareholders, portfolio companies, and society.