Course Index

The NYU Stern MS in Fintech program focuses on innovation in the financial services sector as well as the collaboration across incumbents, start ups, and investors. The program focuses on the three critical areas of fintech - tech transformation, firm adaptation and innovation, and enabling technologies - critical for emerging leadership roles in the space.

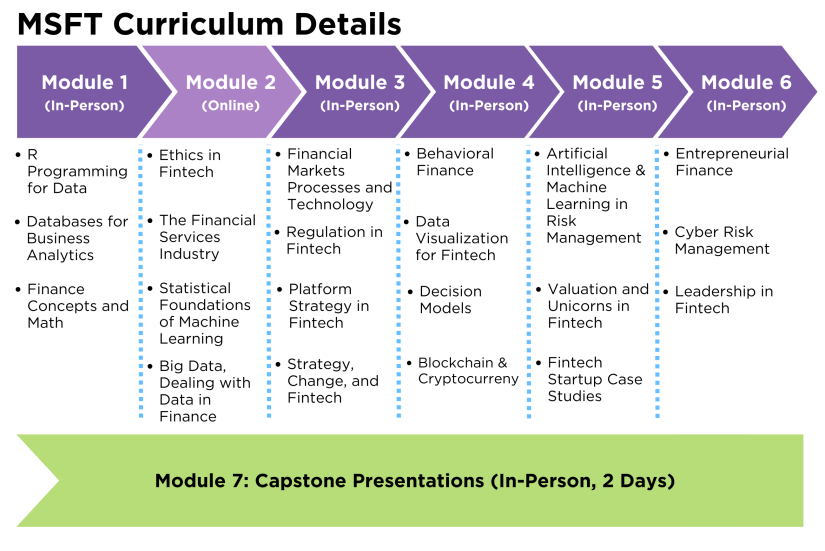

The MSFT program requires students to attend one online and six in-person module sessions. The six in-person modules will take place in key global fintech centers, culminating in the final module where students deliver a presentation on their Capstone project and findings. The list below is an anticipated curriculum schedule, but course descriptions and course content are subject to change as faculty make adjustments to courses in real time to accommodate the most up to date and relevant topics.

The MSFT curriculum is considered lock-step. All courses are required and students take all courses in the order in which they are offered to preserve a cohort-based program experience.

As explained in this short video, the MSFT curriculum covers related topics like risk, regulation, data, ethics, and leadership. The curriculum develops student’s understanding of the operation of the financial system and how technology is leading change in the space to increase accessibility, reduce costs, and improve transparency. The program also explores the application of enabling technologies including blockchain, machine learning, AI, and platform economics and strategies.

Learn More about the Program's Unique Modular Structure

Pre-Program / Pre-Module

Pre-Program runs from February until the start of Pre-Module 1 in April. During this time, the MSFT program will provide matriculated students access to the Admitted Students Website, where they will be able to get more familiar with the program administration, format, logistics, as well as access optional materials to brush up on any skills prior to the Pre-Module period.

Pre-Module 1 is the period from April to May before students participate in the in-person classes in Module 1. During this time, the MSFT program will distribute pre-readings, assignments, and group work so that students can complete their Module 1 course work prior to the in-person session in May.

Module 1 (In-Person)

Previously taught by: Thomas Philippon

This course provides an introduction to the key concepts and the associated analytical tools that are the basic building blocks for all financial analysis. These concepts and tools are essential in order to understand the material in later courses, but they are also interesting and important in their own right. Fintech tests the laws of finance, so we revisit critical finance theories and concepts to prepare you to understand the impact of technology transformation. For example, does the “law of one price” hold up as markets electronify? Will markets remain “efficient” if meme traders influence more equity trading? Are online lending platforms making credit allocation more fair, or introducing new vectors of bias and moral hazard? Will smart contracts reshape insurance? Can fintech unicorns be valued using traditional methods? This course refreshes core finance concepts and math that underpin all financial and fintech functions and businesses.

Previously taught by: Kristen Sosulski

In this course, students will learn how to program in R and how to use R for effective data analysis and visualization. The course begins with developing a basic understanding of the R working environment. Next, students will be introduced to the necessary arithmetic and logical operators, salient functions for manipulating data, and getting help using R. Next, the common data structures, variables, and data types used in R will be demonstrated and applied. Students will write R scripts and build R markdown documents to share their code with others. They will utilize the various packages available in R for visualization, reporting, data manipulation, and statistical analysis.

Students import data sets, transform and manipulate those datasets for various analytical purposes. Students will learn how to create control structures, such as loops and conditional statements to traverse, sort, merge, and evaluate data.

Previously taught by: Panos Ipeirotis

Databases are ubiquitous in all businesses and hold a significant amount of information about the business. Every data analysis and report typically starts with an SQL query, as SQL is the lingua franca of all database systems. Therefore, SQL is a necessity for anyone who needs to analyze data as part of their job, and many tech companies consider knowledge of SQL a prerequisite for all their analysts and managers.

This database class is designed for absolute beginners and teaches students how databases are structured and how to write SQL queries that retrieve data from a database. The class is heavily hands-on, with a focus on developing the necessary skills for writing SQL queries.

Module 2 (Online)

Previously taught by: Jim Finch

This course provides a broad overview of the financial services industry and of the forces that are continuing to change it worldwide. That change/evolution has resulted in a confederation of sometimes integrated products and services within a multi-product firm. It has also resulted in individual stand-alone businesses within those same integrated financial firms, or in boutique, stand-alone, limited product firms. The course focuses on four big questions: (1) Why and what kind of services are provided by participants in the industry? (2) Who develops, provides and regulates those services? (3) How are they likely to be executed or modified in the future? (4) What skills (both technical and "soft") are required for an individual to succeed in the industry? The approach will examine each of the principal businesses in which various financial service firms have been involved, including: raising capital; financial advisory; broker/dealer positions; sales and trading; proprietary investing; managing the assets of others (both institutions and individuals) and risk management. By the end of this course each student should be well versed in the functioning of the industry, be able to understand the financial press and associated economic commentary, be aware of the types of skills necessary to thrive in this industry and have a new perspective on the global financial system.

Previously taught by: Rohit Deo

This course will introduce students to the fundamental concepts of Machine Learning. These include (i) the type of data that can be used, the data structure needed to build predictive models, feature engineering (ii) the principles of training and testing predictive models and the idea of cross-validation (iii) bias (iv) interpretability of models (v) evaluation metrics of models (vi) an introduction to unsupervised learning. As data collected over time is key to many Fintech applications, there will be a discussion of some of the key ideas of time series analysis and the challenges inherent in that.

The topics we will cover in this course begin with an Introduction to Data Science. We will also cover Predictive Analytics Framework; Fitting, Overfitting, and Complexity Control; Evaluation (model performance analytics); Analytical Engineering; and conclude with Management and Data Science.

Previously taught by: Dan Gode

This course will help students learn how to program so that they can effectively retrieve, store, manipulate and visualize data.

Over the span of this course, you will develop practical programming and data manipulation skills using Python. Python is a beginner-friendly programming language that is widely-used in industry. In recent years, it has also become the de facto standard in data science.

The course is roughly split into two halves. The first half lays the foundation by teaching you general-purpose Python programming. The second half focuses on practical tasks when dealing with data. The course will cover: general programming skills (variables, statements, functions, loops, modules); obtaining data from online sources through web scraping; obtaining data from online sources via APIs; querying and storing data in SQL databases; writing and reading data to/from files (including text files, CSV files and Excel files); processing tabular data (using tabel, a modern alternative to pandas); visualizing data (using Bokeh).

Previously taught by: Bruce Buchanan

While presenting the business world with an exciting panoply of emerging models and capacities, the rapidly unfolding field of fintech necessarily confronts it with a whole new set of ethical and professional challenges. Algorithms designed to maximize profits in a data driven environment might also violate rights of non-discrimination and equal protection under the laws. Data sets obtained through social media and other means might lead to serious breaches of privacy, tarnishing the brand franchise while triggering increased regulatory oversight. The black-box nature of AI models raises serious risks of unintended collateral damage to customers and other stakeholders along with deleterious effects on diversity and inclusion. And the lingering possibility of cyberattacks, with their potential for exposing company strategies and proprietary data, hangs over all like a cloud. The senior fintech executive must understand the nature of these and other challenges, and must be capable of formulating ethically appropriate and technologically effective schemas for meeting them. This course will set these questions and issues within the context of business ethics and professional responsibility. As a result, students will finish this course with tools, frameworks, and a clear set of criteria for making nuanced decisions and setting appropriate standards in this dynamic new field.

Module 3 (In-Person)

Previously taught by: Randall Duran

The course begins by examining the role and challenge of institutional investors and goes on to explore how various market participants help address their needs. Concepts related to exchanges, the function of financial market intermediaries, clearing and settlement, and risk management are covered. Additionally, considerations related to market malpractice and trade surveillance are discussed.

Previously taught by: Randall Duran

This course examines the impact of financial and other regulation on fintech. It helps students understand the drivers for and tenants of financial regulation and how it affects firms globally. It explores how regulation shapes business and technology decisions related to lending, payments, and digital assets. Regulation in fintech reviews how regulatory sandboxes have been used by fintech firms and financial institutions to test ideas and garner regulatory support. Additionally, the course compares the different countries' regulatory approaches and looks at future trends in fintech regulation. Real-world case studies are used bring to key concepts to life and relate them to practical business concerns.

Previously taught by: Joe Porac

The goal of this course is to understand why organizations often fail to realize a return on their analytics investments. The course argues that, while there are clearly technical and skill-based reasons why some firms struggle, most of the impediments arise from organizational issues. Specifically, the contextual business knowledge and the analytics knowledge in most organizations are separated from one another, which creates real problems both for asking good questions and for understanding what to do with the output from analytics efforts.

To address these issues, students will seek to understand the link between strategy (the most integrative business function in most firms) and analytics. Analytics is about improving decision making, and strategy is all about making value creating decisions, so the two are a natural fit together. Students will explore how to use data – both small data and big data – to improve decision making and value creation in organizations.

Previously taught by: Arun Sundararajan

This course covers economic concepts that are key for fintech strategy. The course begins with Lock-In, Network Effects and Positive Feedback, then discusses two-sided markets (platforms). This leads to discussion of Platform Strategies, such as market entry, pricing and platform competition, focusing on how competition is different in Platform markets. The readings from the economic literature, managerial literature and popular press and blogs provide an introduction to the concepts, analysis of their implications, and a strategy toolkit. The concepts and strategies in this course are further illustrated and discussed with cases. The course concludes with a look at how blockchain technologies such as enterprise blockchains and platform-specific digital tokens can be used to implement and strategically support fintech platforms.

Module 4 (In-Person)

Previously taught by: David Yermack

This course introduces students to digital currencies, blockchains, and related topics in the fintech area, perhaps the most significant innovation in the financial world since the advent of double-entry bookkeeping centuries ago. The technology appears to represent an existential challenge for major parts of the finance industry. It is now commonly suggested that commercial banks and stock exchanges may no longer exist, or may become much smaller, within the next 10 to 20 years, with increasing volumes of payments and exchange taking place on a decentralized basis inspired by the 2009 launch of Bitcoin.

The course will begin with a study of the nature of money and legacy payment and banking systems. Students will then study the emergence of stateless, cloud-based digital currency systems since 2009. Further lectures will explore threats that blockchain technology poses to incumbent firms and their resulting attempts to co-opt the technology into existing business models. Students survey related issues including hacking, “smart contracts,” governance, and especially emerging regulation.

Previously taught by: Jiawei Zhang

This course introduces the basic principles and techniques of applied mathematical modeling for business decision making. Students will learn to use some important analytic methods such as optimization and Monte Carlo simulation, to recognize their assumptions and limitations, and to employ them in decision-making.

Previously taught by: Ian D'Souza

Finance theory has long relied on a descriptively sparse model of behavior based on the premise that investors and managers are rational. Another critical assumption is that misjudgments by investors and managers are penalized swiftly in competitive markets. In recent years both assumptions have been questioned as the standard model fails to account for various aspects of actual markets. Behavioral finance, which allows that investors and managers are not always rational and may make systematic errors of judgment that affect market prices, has emerged as a credible alternative to the standard model. This course provides an exposition of the insights and implications of behavioral finance theory showing how it can explain otherwise puzzling features of asset prices and corporate finance. Notwithstanding the inroads of the new theory the standard model retains strong support amongst many academic practitioners who make criticisms of behavioral finance that deserve serious consideration. An important challenge that we will address in this course is identifying the respective domains of each perspective and whether there are tradable opportunities. We examine behavioral finance in three stages by analyzing the basics of the behavioral finance and then applying this to centralized and decentralized fintech. Learning objectives include: (1) explore investor behavior in financial markets – from the traditional (i.e., rational, bell curve) market perspective (efficient market hypothesis) to the emerging area of behavioral finance with inputs for systematic investor biases (i.e., irrationality, non-normal distribution), (2) test select psychological biases/heuristics (“rules of thumb”) in controlled class experiments , (3) specifically examine points 1 and 2 as it relates to Centralized and Decentralized Fintech.

Previously taught by: Kristen Sosulski

This course is an introduction to the principles and techniques for visualizing financial data. This course shows you how to better understand your data, present clear evidence of your findings to your intended audience, and tell engaging data stories that clearly depict the points you want to make all through data graphics.

You will learn visual representation methods and techniques that increase the understanding of complex data and models. Emphasis is placed on the identification of patterns, trends and differences from data sets across categories, space, and time.

The ways that humans process and encode visual and textual information will be discussed in relation to selecting the appropriate method for the display of quantitative and qualitative data. Graphical methods for specialized data types (times series, categorical, etc.) are presented. Topics include charts, tables, graphics, effective presentations, multimedia content, animation, and dashboard design.

Throughout the course, several questions will drive the design of data visualizations. These include: Who’s the audience? What’s the data? What’s the task? What’s the best visual display? This is a hands-on course. In this course, we will focus on using Tableau to create, edit, alter, and display your data graphics. To learn these tools, we will begin working with some very small data sets to practice and then advance to larger data sets. Since this is not a class on data analysis or models, you’ll be expected to apply your prior knowledge of statistics, data mining, and data science to the creation of beautiful data displays (using big or small data).

Module 5 (In-Person)

Previously taught by: Rob Seamans

This class uses a blend of academic papers, research reports, popular press and real-world cases to assess and address the various sources of risk arising within organizations using artificial intelligence (AI) or machine learning (ML) technologies. Students will catalog these risks and discuss ways to mitigate them. We will do “deep dives” on two topics that have received lots of attention lately – the risks associated with using AI in HR, and the use of special boards to address ethical issues arising from use of AI.

Previously taught by: Kathleen DeRose

In this course, students will: (1) develop expertise at valuing fintech businesses throughout their lifecycle, from venture-funded birth to large scale public companies, using both top down market-structure, and bottom-up business analysis frameworks applicable to all fintech businesses, for use in investment, merger and acquisitions, and project design, (2) understand the impact of spread and fee businesses and regulation on fintech valuation, (3) explore the peer-to-peer lending business as a case of disintermediation and re-intermediation, (4) apply the latest thinking about unicorn valuation to well-known fintechs.

Previously taught by: Kathleen DeRose

In this course, students will: (1) develop understanding of technology-led change in three of the five financial functions (payments, markets, and capital allocation-wealthtech) through detailed case analysis, (2) assess the technology, regulatory, partner, and customer acquisition strategy of an early-stage payments startup by analyzing a due diligence document from an angel group, (3) assess the potential for platform success in a late-stage startup automating bond trading, and determine whether market electronification undermines classic finance theories, by analyzing the impact of information provision on trading, (4) assess the value-creation and channel strategy of a mid-stage fintech startup in wealthtech by evaluating whether the company should enter a new channel, (5) visit the latest startups, meet founders, and assess their teams, strategy, and business cases based on what was learned in class, and (6) from the above, develop a tool kit for fintech startup evaluation.

Module 6 (In-Person)

Previously taught by: Sabrina Howell

This course will introduce you to the financing lifecycle of high-growth new ventures (startups). Students will focus on how startups are funded by VCs and acquired by corporations, learning the “VC Method” of valuation and the key terms of deals between startups and investors. Students will also explore how fintech intersects with entrepreneurial finance.

Previously taught by: Judith Germano

Cyber Risk Management is a critical component of a fintech enterprise risk strategy. It is essential to understand and prepare for various types of cybersecurity and data privacy risks and vulnerabilities, attack scenarios and related civil and regulatory obligations and liabilities. Failing to properly prepare for and respond to cybersecurity and data privacy incidents can seriously harm or even destroy an enterprise and cause serious harm, if not also potential criminal liability, for business leaders. Ransomware attacks, stolen and exposed confidential business information, lost and altered data, and system outages are all-too-common problems as companies of all sizes struggle to manage cyber risk. These challenges are intensified for multi-national corporations navigating different laws and regulations regarding online privacy, data protection and security. And a remote workforce adds greater levels of complexity. It is essential that organizations and their leaders adequately understand, anticipate, prepare for, and properly respond to, cybersecurity incidents. How an organization handles security incidents is critical to its reputation, revenue and relationships with clients, customers, regulators and others. Organizations must swiftly, efficiently and effectively address security incidents. This requires thoughtful planning, action and communication, not only during an incident, but also before and after incidents. This course will address significant trends and challenges of cyber risk management; explore case studies demonstrating successful and also failed incident response situations; discuss key legal and regulatory frameworks for understanding proper cybersecurity preparedness and crisis response; and if time permits could also include one or more guest speakers and also a tabletop exercise scenario of a cybersecurity crisis response in which the class would actively participate.

Previously taught by: Nate Pettit

This course provides: (1) Frameworks to examine leadership in fintech group/organizational settings, (2) Tools and opportunities (and reasons) to act on what you learn to be a leader. A student’s ability to analyze behavior in collective settings, and willingness to skillfully act within them, help answer a number of questions: Why do some talented people succeed, while others, equally talented, flounder? Why do some people in leadership positions prove effective, while others do not? Why do some people become leaders and others do not? This course tackles these questions. The course is based on the premise that, regardless of your position within an organization, leadership opportunities and challenges present themselves every day and that it is to your advantage to recognize and make the most of these opportunities.

Module 7 (Capstone)

The MSFT Capstone is an integrative team project that gives students the opportunity to demonstrate an understanding of the core competencies taught throughout the program and apply them to real business concerns. The result is a unified and practical case presentation on a topic of the group's choosing. This is a team-based project with approximately 4-5 students per group. Capstone work runs throughout the duration of the program, starting in Pre-Module 1. Capstone includes deliverables assigned from specific courses, as well as a charter, executive summary, first draft, and final draft. Students will practice presenting Capstone materials at various stages throughout the year leading up to the final presentation in Module 7.

Authoritative curriculum information can be found exclusively in the University Bulletin. All other content, including this page, is for informational purpose only. You can find the curriculum for this program on this page of the Bulletin.