The Cautionary History of Debt-Limit Gimmicks.

By Thomas Sargent and George J. Hall

The U.S. Congress began imposing debt limits in 1776. When the Continental Congress authorized its very first loan from France, it instructed U.S. commissioners to borrow a “sum not exceeding two million sterling.” Congress continued to permit the Treasury to borrow only up to bond-by-bond specific limits until 1917. Prior to then, U.S. Treasury secretaries actually operated under multiple debt limits, authorized bond by authorized bond. The single, aggregate debt limit we’re more familiar with today was first adopted by the U.S. in 1939.

The multiple debt limits of that earlier era occasionally constrained the actions of presidents and their Treasury secretaries. Presidents at times tried to circumvent the limits, and usually suffered consequences for subverting congressional intent. One such episode provides a cautionary tale for advocates of various gimmicks to confront the current debt-limit crisis, such as minting a $1 trillion platinum coin. But first, it’s important to understand how Congress authorized spending and managed U.S. Treasury debts before World War I, and how those multiple debt limits worked.

From 1776 to 1917, whenever Congress authorized a secretary of the Treasury to spend, it gave the secretary detailed bond-by-bond instructions about how to fund newly authorized spending. Laws raised particular taxes and authorized the Treasury to issue new securities. A congressional committee designed each new security. Congress specified the coupon rate, the term to maturity, possible tax exemptions and call features, and whether principal and coupons would be paid in gold, silver, or paper currency. Congress also specified particular purposes for which the proceeds of a bond sale could be spent.

Read full Barron's article.

___

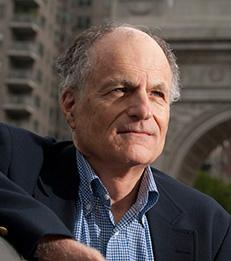

Thomas Sargent is William R. Berkley Professor of Economics and Business at NYU Stern School of Business.